yVaults

The goal of the Vaults program is to empower the community to quickly and safely create and utilize the most effective yield farming robots created by the industry's best strategists.

yVaults have a 0.5% withdrawal fee and a 5% fee on additional yield whenever the harvest() function is called, see the FAQ for more details. Individual profits are allocated on a pro-rata basis determined by the share each depositor contributes to the pool.

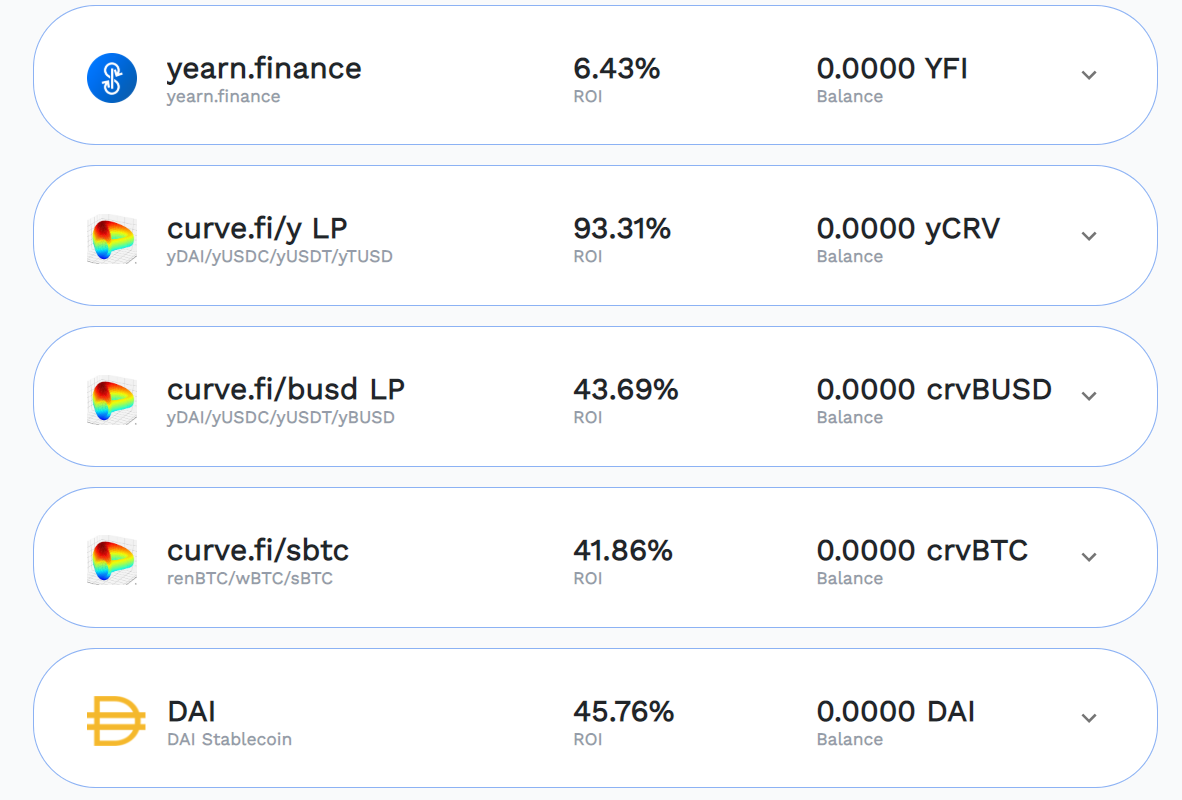

Available yVaults

There are currently nine yVaults. You can access them here: https://yearn.finance/vaults 1. ETH/WETH 2. YFI 3. yDAI+yUSDC+yUSDT+yTUSD (yCRV) 4. crvBUSD 5. crvBTC 6. DAI 7. TUSD 8. USDC 9. USDT

The tokens identified above are deposited into their respective yVaults and used to yield farm using current opportunities in the market.

The vaults are created and maintained by a Controller, who oversees the strategy execution. Profits generated from each respective vault are used to purchase more of the underlying asset in each vault (e.g., the YFI vault's profits are used to purchase additional YFI); therefore, the vaults represent a a continuous buy-and-hold strategy.

yETH Vault Mechanics

The Controller opens a colleratlized debt position (CDP) at MakerDAO using ETH as collateral and mints DAI. The DAI is deposited into the yDAI vault. The collateralization ratio—a metric of financial leverage—is targeted to always be at least 200%. Automated bots periodically pay down the DAI debt if the ratio falls below 200%. The DAI is redeemed from Curve and is not purchased from the open market (i.e., yDAI is burned and redeemed for DAI). Excess DAI earned from yield farming are used to purchase additional ETH, which is deposited into the yETH vault.

Delegated yVaults

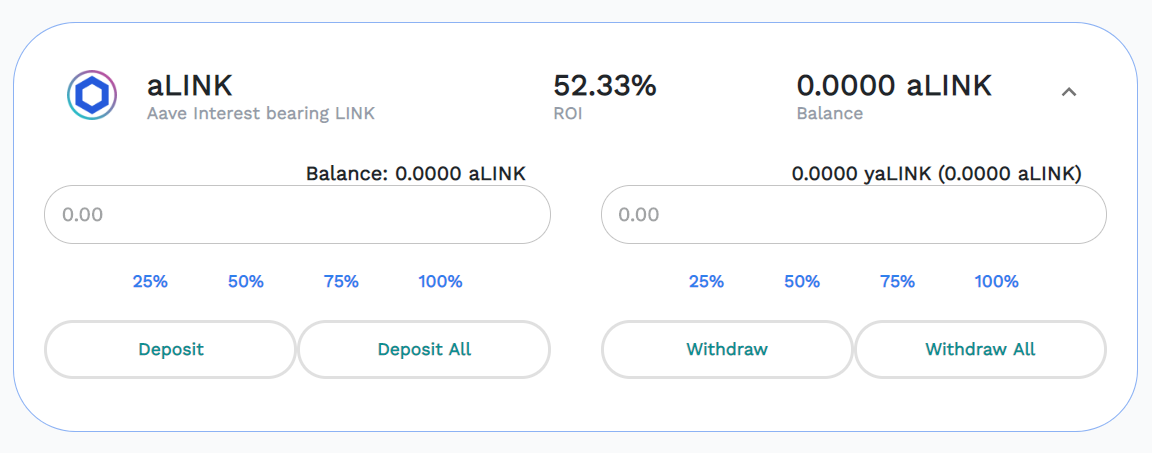

Volatile assets can also particpate in yield farming strategies as part of the delegated yVault product. Currently, there is only one delegated yVault: aLINK.

Profits generated from the delegated yVault are used to purchase more of the underlying asset. Once again representing a continuous buy-and-hold strategy, allowing the depositor to remain 100% exposed to the asset. Depositors can withdraw their initial deposits and accrued profits, if any, at any time after a 0.5% fee taken on deposit.

Mechanics

The Controller deposits LINK into AAVE and borrows stablecoins. If at any time the health factor drops below the vault's configured value (currently set to 2), the Controller repays a portion of the debt in order to maintain a health factor above its configured value.

The stablecoins borrowed (e.g., USDC, DAI, USDT, etc.) depend on the strategy selected by the Controller. After obtaining stablecoins the Controller will deposit them into one of the yVaults identified above.

Resources

Medium Article: yETH vault explained

Medium Article: Delegated Vaults Explained

Last updated