Governance

YFI holders govern the Yearn ecosystem and are eligble to receive a portion of protocol profits. Therefore, YFI represents a right to govern the platform and a claim on earnings. Profits are obtained from each of Yearn's products.

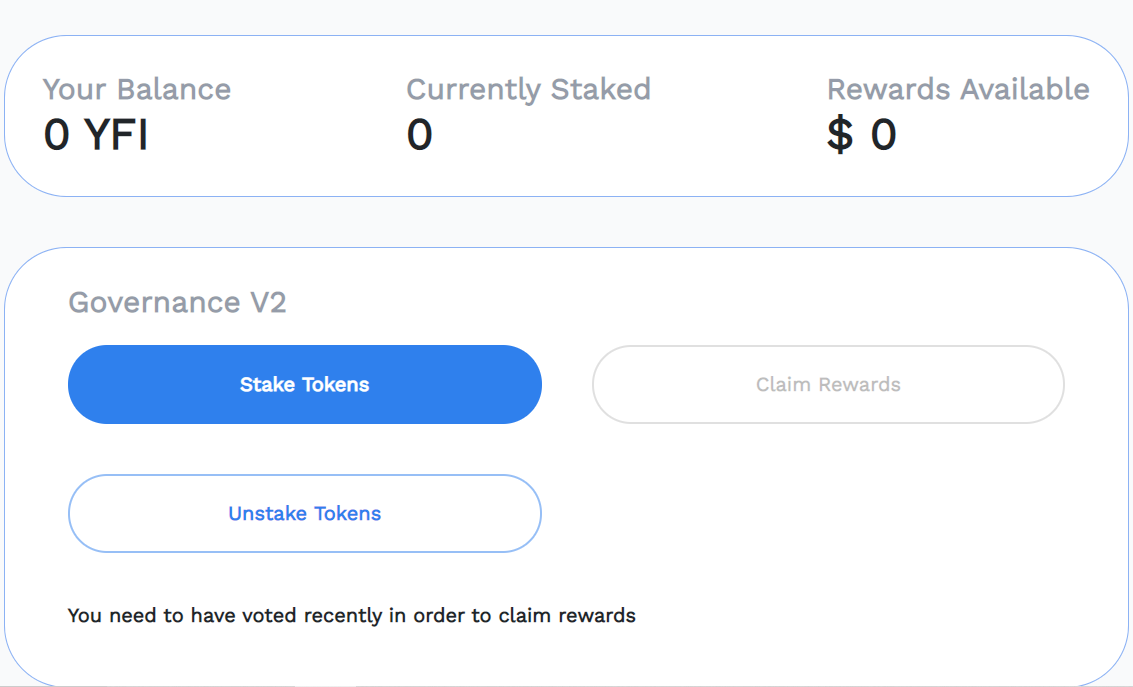

In order to claim profits, YFI holders stake their tokens into the Governance contract. Profits are periodically sent to this contract from the Yearn Treasury Vault, which temporarily holds profits before distribution to stakeholders. Profits are sent to the Governance contract after the Treasury Vault has accrued a $500,000 reserve; this reserve is used to pay for various operational expenses, including developer compensation and community grants. The amount retained in the Treasury contract before profits are sent to the Governance contract are subject to change by YFI holders.

In order to vote on proposal changes to the ecosystem YFI holders must be staked in the governance contract. Stakeholders are unable to withdraw their deposits for 72 hours after voting. They are also unable to claim their share of accrued, but undistributed profits, unless they have voted in a recent proposal. Profits are distributed as yCRV tokens.

The staking portal simplifies this process and can be found here.

Last updated